Why should we be interested in a new research paper from the Journal of Financial Counseling and Planning? Here are five reasons.

- The research team involved – of whom Dr Eglington and now Dr Schuetze (congratulations) continue to be very supportive of educators like myself, looking to leverage the insights from research to support the pupils in their classrooms.

- It is from a generalisable curriculum area – financial education. Which also happens to be reportedly difficult to impact upon.

- Conducted as a field experiment – more like teaching.

- Over an extended period of time (5 months) – more like teaching.

- The outcome – you will have to wait.

Spaced Retrieval Practice and Edtech

Kang et al., (2023) are quick to summarise a wealth of research demonstrating that “testing can enhance learning” – that retrieving information from memory improves retention as well as its transfer or application to novel contexts, relative to rereading. Second, feedback and explanatory feedback that elaborates on why an answer is correct boosts the transfer of learning to new situations. Third, spacing out the review of the information over time benefits learning. Moreover, these principles are complementary. I will spare you the references for these three principles as there are many.

As for Edtech. It is big. A global market exceeding US$89 billion in 2020 and a projected compound annual growth rate of about 20% from 2021

to 2028 (Grand View Research, 2021). We have phones. We need data.

The study

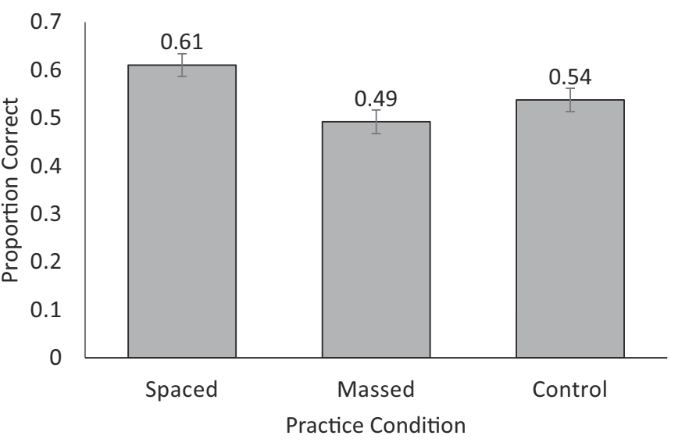

Kang et al., (2023) designed an app for use after a compulsory 1.5 hours financial education workshop for 275 undergraduates, randomly assigned to one of three groups. A control (no practice), massed, or spaced retrieval practice with elaborative feedback. A final assessment 20 weeks after the last practice (or exposure to the content, for the control condition) to evaluate the efficacy of the intervention. A $10 Amazon gift certificate sweetener for participating and a $40 Amazon gift certificate for completion.

182 completed all the sessions/tasks (61, 53, and 68 in the spaced, massed, and control conditions) and their data were included in the analysis. A higher percentage of males dropped out and I thought that was interesting.

The app notified participants when it was time to do an activity (and provided multiple reminders), allowed participants to do study related activities during appointed time windows, and recorded participants’ responses during the activities.

What did they learn: Three sets of 10 multiple-choice questions around the content of the workshop.

Assessment: Questions from the sets, two metacognitive questions, and four questions related to participants’ financial behaviours since the workshop.

What did we learn?

We find that a spaced retrieval practice intervention in a Financial Education workshop facilitated via mobile app is effective at increasing financial knowledge after 5 months (d = 0.6).

Dr Schuetze

Spaced retrieval improved financial knowledge. (However, the level of subjective confidence did not vary significantly, nor was there reliable evidence that practice conditions influenced financial behaviours.)

Takeaways

In conversation with Dr Schuetze, he added “yet more research that adds to a growing body of research that shows that spaced retrieval practice works in real-world settings (see Dr. Agarwal’s work), and can be relatively easily implemented using technology.”

Spaced retrieval improves knowledge retention – out in the wild, with “just two short bouts of practice each lasting less than 10 minutes,” 5 months after initial learning! And whilst the undergraduates failed to report any difference in subjective confidence or behaviour, we know that financial literacy is a significant predictor of financial behaviours, (Kaiser & Menkhoff, 2017).

What advice can we take from the research? Getting pupils “retrieving the critical information from memory, spread out over time, and coupled with corrective feedback which explains and elaborates on the concepts helps consolidate the learning and make it more durable and transferable in the long term.